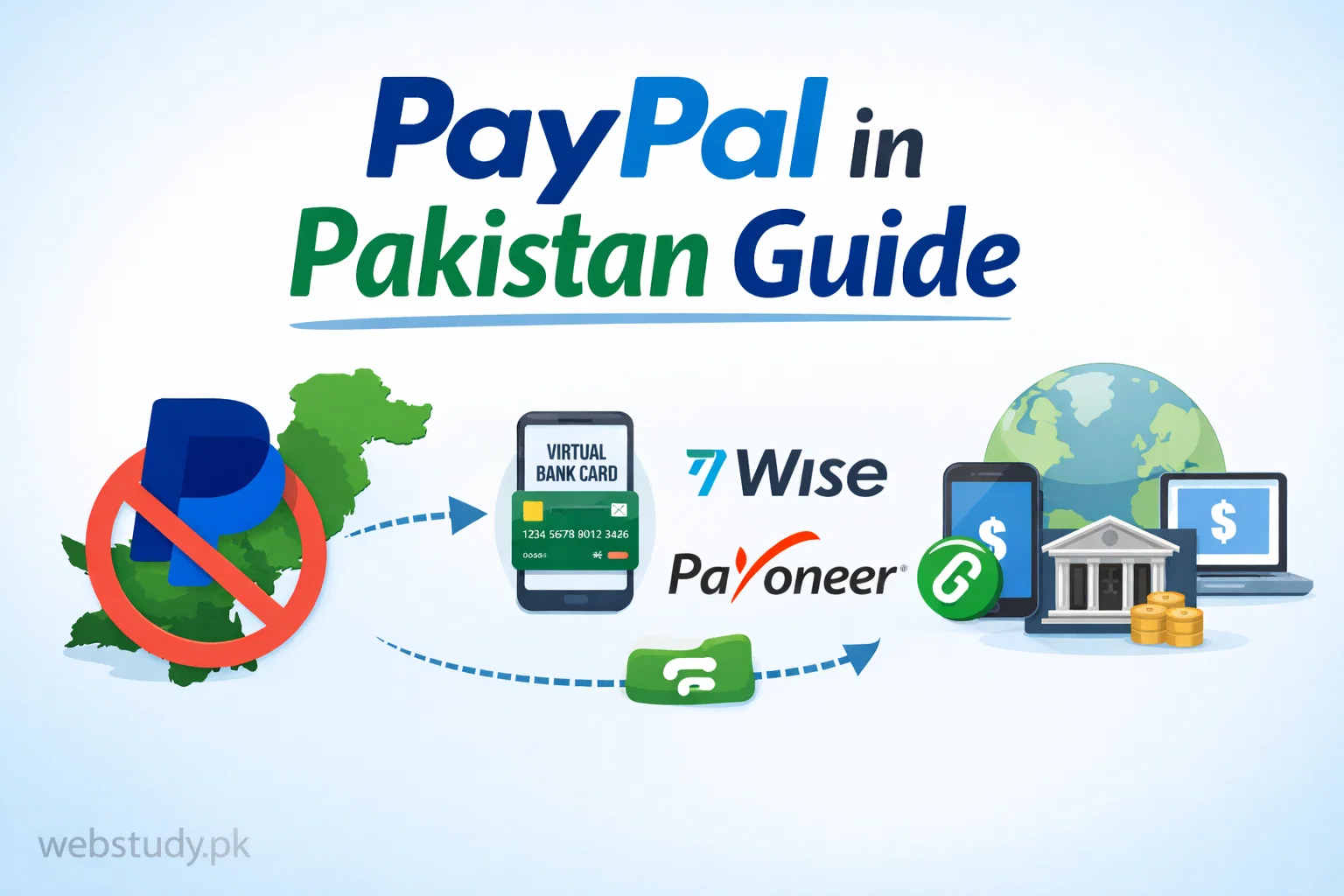

However, despite years of discussion, PayPal has still not officially launched in Pakistan as of 2026. This continues to affect freelancers, YouTubers, bloggers, SaaS founders, and remote workers who rely on global clients.

That said, many Pakistanis still interact with PayPal indirectly through compliant third-party setups and alternative platforms. This guide explains the current reality in 2026, the risks involved, what still works, and when it’s smarter to use alternatives.

Current Status of PayPal in Pakistan (2026)

As of January 2026, PayPal:

- ❌ Does not offer official personal or business accounts for Pakistan

- ❌ Does not support direct Pakistani bank withdrawals

- ❌ Does not provide local customer support

The State Bank of Pakistan (SBP) has confirmed in past briefings that discussions with PayPal took place, but no launch timeline or regulatory clearance has been announced.

Bottom line:

If someone claims “PayPal is now officially live in Pakistan,” that information is incorrect.

Can Pakistanis Still Use PayPal in 2026?

Some users access PayPal by linking it to supported countries, but this comes with strict conditions and real risk.

Commonly used regions:

- United States

- United Kingdom

- United Arab Emirates (UAE)

These setups depend on foreign residency signals, not Pakistani ones.

Requirements to Use PayPal Indirectly (2026 Reality)

1. A PayPal-Supported Country Profile

You must register PayPal under a country where it officially operates.

Best-supported options:

- 🇺🇸 United States

- 🇬🇧 United Kingdom

- 🇦🇪 UAE (business-focused)

2. A Compatible Bank Account

PayPal now performs deeper verification checks in 2026, so the bank account must match the country of registration.

Commonly used options:

- Wise – provides US/UK receiving accounts after full KYC

- Payoneer – supported by many freelance platforms

⚠️ Note: Not all Wise or Payoneer accounts are accepted anymore. PayPal may reject mismatched profiles.

3. Verified Address and Phone Number

PayPal now cross-checks:

- Address history

- Phone number origin

- Login IP behavior

Disposable or low-quality virtual numbers are high-risk in 2026.

4. Identity Verification

Required documents typically include:

- Passport

- Proof of address

- Business documents (for business accounts)

Any inconsistency can trigger permanent limitation.

Step-by-Step Overview (What Still Works, Carefully)

Method: Using Wise or Payoneer (Higher Compliance)

Step 1:

Open and fully verify a Wise or Payoneer account using accurate information.

Step 2:

Register a PayPal account in the same country as your bank details.

Step 3:

Link the bank account and wait for PayPal’s micro-deposit verification.

Step 4:

Use PayPal only for small, consistent transactions initially.

⚠️ Even when done correctly, there is no zero-risk method for Pakistan-based users.

High-Risk Method: Friend or Relative Abroad

Some users operate PayPal accounts through trusted family members overseas.

Major risks:

- Account ownership is not yours

- Funds can be frozen or disputed

- Tax and compliance issues

This method is not recommended for long-term or high-value use.

Account Limitations and Risks (Very Important)

In 2026, PayPal uses:

- Advanced IP pattern detection

- Machine-learning fraud models

- Cross-platform data signals

Common triggers for suspension:

- Pakistani IP logins without travel history

- Sudden large payments

- Address mismatches

- Repeated VPN usage

Once limited, recovery is rare.

Fees and Cost Considerations

- High currency conversion charges

- Withdrawal delays

- Double fees when routing through Wise or Payoneer

- No local dispute resolution

For many users, PayPal becomes expensive and unstable.

Best PayPal Alternatives in Pakistan (Recommended for 2026)

1. Payoneer

- Widely accepted by Upwork, Fiverr, Amazon, and agencies

- Direct PKR withdrawals

- Pakistani tax documentation supported

2. Wise

- Transparent exchange rates

- Multi-currency holding

- Works well for international clients

3. Skrill

- Available in Pakistan

- Limited but functional

4. Local Options

- JazzCash

- EasyPaisa

Useful for domestic or hybrid payments.

FAQs (Updated for 2026)

Can I open PayPal in Pakistan directly?

No. PayPal still does not support Pakistan officially.

Is indirect use illegal?

It is not illegal, but it violates PayPal’s terms if misrepresented.

Will PayPal launch in Pakistan in 2026?

There is no official confirmation as of now.

What’s safer than PayPal?

Payoneer and Wise offer more stability for Pakistan-based earners.

Final Recommendation for webstudy.pk Readers

If your income depends on reliability, do not build your business around PayPal in Pakistan.

Use PayPal only if:

- A client demands it

- Payments are small

- You understand the suspension risk

For serious freelancers, agencies, and online businesses in 2026:

Payoneer or Wise is the smarter, safer choice.

Closing Note

PayPal remains a powerful global platform, but Pakistan is still outside its official ecosystem. Until regulatory approval happens, users should focus on compliant, sustainable payment solutions rather than risky workarounds.

If PayPal’s status changes, webstudy.pk will update this guide with verified information.

Fahad Munir is an experienced Pakistani education writer at Webstudy.pk focusing on study guides, market rates, and learning resources with clear, practical insights for students.